Commission and service charge. Employers who do not comply with the EIS could be subjected to legal action including maximum fine of RM10000 or two years jail or both if.

First Category Employment Injury Scheme And Invalidity Pension Scheme This is applicable for employees aged below 60.

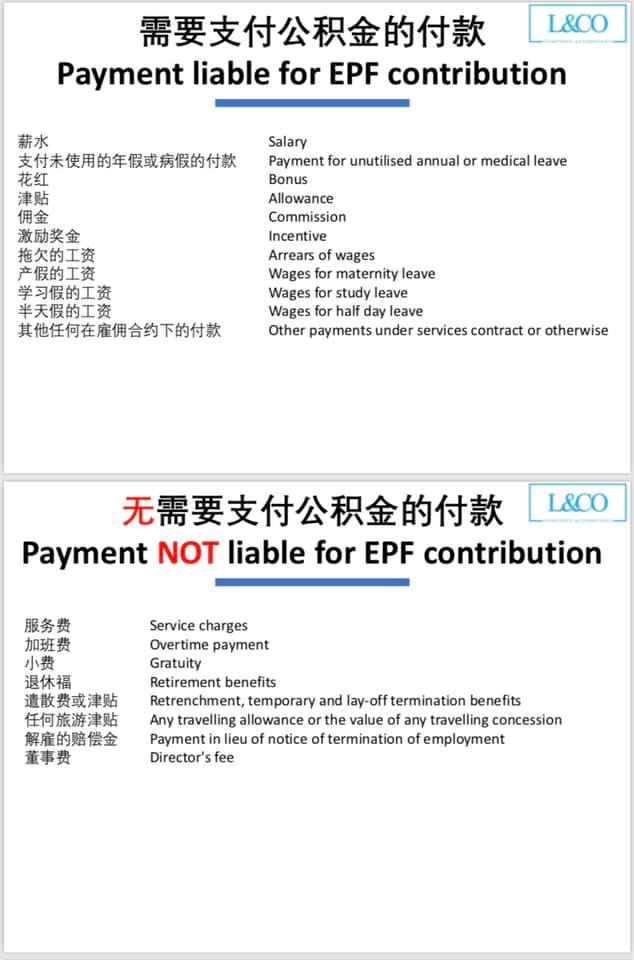

. Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as the EPF a social security fund established under the EPF Act to provide retirement benefits to employees working in the private sector. The remuneration or payable to employees are subject to SOCSO. From malaysia employment income is derived from subject to malaysian tax where.

Payments Subject to SOCSO Contribution. In general all monetary payments that are meant to be wages are subject to EPF contribution. It is noted that the contributions to EIS is capped at a monthly salary level of RM4000.

Allowances except a few see below Commissions. Can wages be not subject to socso. It is compulsory for all Malaysian and permanent resident employees to register with SOCSO except for Federal and State Government permanent employees domestic servants and those who are self-employed.

The maximum eligible monthly salary for SOCSO contribution is capped at RM4000. Additionally the following list of payments must be included when calculating EPF contributions for employees in Malaysia. The EIS is intended to act as a safety net for employees in the event of retrenchment or unemployment due to bankruptcy or any other reasons for insolvency of employers.

什么是董事费 the annual fees paid by any. B Check with MTD listing to get MTD amount RM7000 for single MTD RM46085 c New MTD amount Original MTD amount. This includes the following payments.

Any remuneration payable in money to an employee is taken as wages for purposes of SOCSO contributions. Contribution wage refers to the monetary compensation paid by an employer to an employee. In short yes bonuses and cash allowances are considered to be part of your wages.

Employer and its employees must be registered with SOCSO not later than 30 days on which the Act becomes applicable to the industryFor the purpose of registration an employer is required to complete the Employers Registration Form Form 1 Employees Registration Form Form 2 together with relevant documents specified please get the checklist through our website or. Gratuity payment s for dismissal or retrenchments. Within 48 hours report any work-related accidents that occur to their employees.

For the month of September they receive a bonus of RM250 as. The following wages or remuneration payable to staffworkers are NOT subject to SOCSO contribution. Payments by employer to any pension or provident fund for employees.

Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary. The employers contribution to the SOCSO is their obligation. The extent of the employers obligation to.

Payments Exempted From SOCSO Contribution. After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age. Contribution rates are set out in the Second Schedule and subject to the rules in Section 18 of the Employment Insurance System Act.

SOCSOs Rate of Contribution. Wages subject to SOCSO contribution. The employer should then send this form to EPF.

02 will be paid by the employer while 02 will be deducted from the employees monthly salary. For better clarity do refer to the SOCSO Contribution Rate table-----Who is eligible for SOCSO deductions and contributions. A Bonus 12 monthly salary RM12000 12 months RM6000 RM7000 months.

Payments for unutilized annual or medical leave. Among the payments that are exempted from SOCSO contribution include. Any gratuity payable on discharge or retirement of the employee.

The EIS will be operated and administered by the Social Security Organisation. In the first category for the most part the employer is to pay 175 of the employees total salary towards the fund and the employee is to pay 05 of their salary amount towards the fund. Payments Exempted From SOCSO Contribution.

Allowances incentives shift food cost of living housing etc Wages NOT subject to SOCSO contribution. - Payments in respect of leave. Enroll your staff in the SOCSO and maintain their information up to date.

PERKESO JADUAL CARUMAN 27082021. Wages subject to SOCSO contribution. In simple terms there are two categories of the SOCSO fund.

Then the total amount is the addition of these two and will go towards the SOCSO fund. Malaysian PR above 60 years old and Foreign Employees. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme.

The payments below are not considered wages and are not included in the calculations for monthly deductions. This simply means that if a person earns more than RM4000 a month the contribution is still fixed at RM790. Types and Categories of SOCSO Contributions.

Monetary payments that are subject to SOCSO contribution are. This system is applicable to the private sector which is estimated to benefit 66 million workers. Annual bonus needs to be divided into 12 months during calculation Lets say the bonus is RM12000 monthly salary RM6000.

Keep a monthly record of personnel. Any contribution payable by the employer towards any pension or provident fund. Foreign workers are protected under SOCSO as well since January 2019.

For example employee A earns RM6000 per month as their basic salary. Wages subject to SOCSO contribution. However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021.

For SOCSO provide social security protections to all employeesworkers in Malaysia the requirements for contribution are as below PERKESO TATACARA PORTAL ASSIST. Director salary is similar to salary paid to staff which it is subject to epf socso pcb. B fees including director fees commission or bonus.

Paid leave annual sick and maternity leave rest day public holidays Allowances. Payments by employer to any pension or provident fund for employees. Within 30 days of employing your first employee register as an employer.

Such as annual sick maternity rest day public holidays and etc. Malaysian PR below 60 years old Employee.

Reka Tulin Services Home Facebook

Sql Payroll What Is Subject To Socso Malaysia Best Payroll Software

Pin By Khairul Anuar On Chin Chun Marketing Marketing Map Chin

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Sql Payroll What Is Subject To Socso Malaysia Best Payroll Software

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

What Wages Are Subject To Socso Contribution Nbc Com My

What Wages Are Subject To Socso Contribution Nbc Com My

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

Remuneration That Subject To Employees Provident Fund Epf Socso Eis Hrdf Hills Cheryl

Sql Payroll What Is Subject To Socso Malaysia Best Payroll Software

Socso Social Security Organization Iperkeso

Gunung Seraya Wood Products Gswproducts Twitter